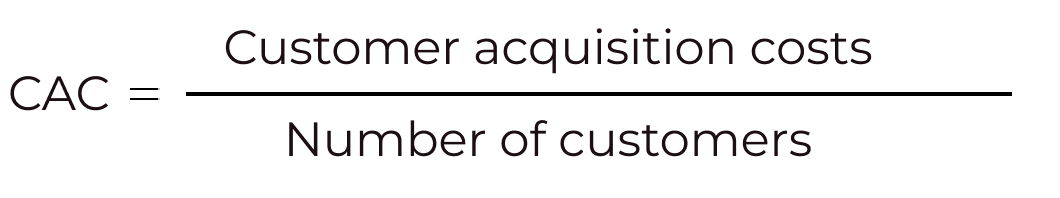

Acquisition costs include advertising fees, salaries of marketers and content specialists, as well as other related expenses.

Let’s say a company launched contextual advertising in Yandex.Direct and spent 5,350 mana on it. Another 1,500 mana. went to pay for the work of a marketer and 300 mana. — for a subscription to a service for advertising automation.

Thousands of people came from the advertising campaign, but only 23 of them made an order. Let's calculate the cost of attracting a client:

CAC = (5350 + 1500 + 300) / 203 = 35.2 mana.

This means to get one buyer from contextual advertising, you need to spend an average of 35.2 manats.

Why calculate the cost of customer acquisition?

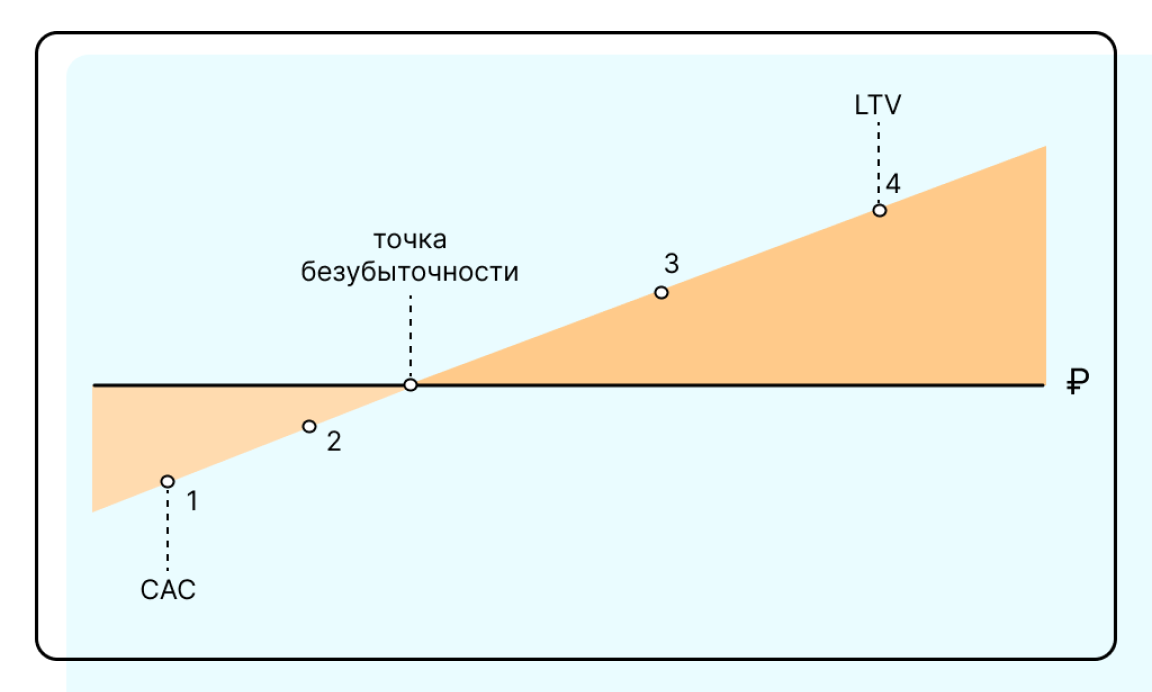

Check if the investment is paying off. CAC shows how much you spent to attract a buyer. If, along with CAC, you evaluate the average bill and lifetime value of one customer (LTV), you can understand whether the company is performing positively or negatively.

Find effective and ineffective channels. If the costs for the promotion channel are high and there are few customers, we will get a high customer cost. This means the channel gives a bad result. If the CAC turns out to be low, this shows that the costs are relatively low, but a lot of customers come. Such channels need to be given more attention.

Optimize promotion. If the CAC for a certain channel is too high (above the average ticket and LTV), it means that you should either abandon this channel completely or optimize your work with it.

What should the CAC be?

The general rule is the lower the better. But CAC itself is not informative: you need to look at it in conjunction with the average ticket or LTV.

A good CAC is usually lower than the average check

Let's imagine two situations:

CAC is 1000 manats, and the average buyer’s check is 10,000 manats;

CAC is 100 manats with an average bill of 94 manats.

In the first case, the income comes out to 9 thousand, in the second - minus six manats, although the customers of the second store cost ten times less than the first. It turns out that if customers do not return for a second purchase, the second store operates at a loss.

Comparing CAC with the average ticket is effective if it is not possible to calculate a more accurate metric (LTV) - for example, there is not enough data. Or if the industry standard is that customers make one big purchase and leave: for example, in the field of custom kitchen units.

Good CAC is lower than total customer value

LTV is how much profit the buyer brings during the entire time of communication with the company. For example, a client with SEO traffic bought something worth 500 manats every month for six months, and then left. Then its value is 500 * 6 = 3000 manat. If you compare this number with CAC for SEO traffic, it becomes clear how profitable the promotion turned out to be.

If the CAC of such a client is also 3,000 manat, then the company did not receive any profit, but it did not go into the red either.

CAC less than 3 thousand means the company is in the black.

CAC above 3 thousand means the company is operating at a loss.

Comparing CAC with LTV is usually more revealing than with average ticket. This option is suitable for businesses focused on long-term cooperation or repeat sales: subscription services, online stores, etc.If LTV is higher than CAC, the average ticket may be lower than the cost of acquisition - the company will still be in the black. For example, one cosmetic procedure may cost less than CAC. But the procedures are course-based, and if the client liked everything, he will return and the attraction will pay off.

Some experts believe that the optimal LTV to CAC ratio is 3:1, although much depends on the industry. But if you achieve such an indicator, you can talk about effective marketing.

How to correctly count clients for calculations

For the indicator to be objective, you need to avoid “losing” customers and not adding extra ones. This way, CAC will be more accurate and bring more benefits. Here are some points to consider.

View the number of buyers over time. Clients may not come immediately after promotion starts. The return from SEO appears at least a month after the start. Therefore, it is worth storing analytics data for historical periods and checking how the CAC indicator changes over time. To do this, they connect end-to-end analytics and CRM.

Collect analytics at all stages of the funnel. A person can come from an advertisement and place an order by phone, rather than through a website. To make CAC more accurate, such a buyer also needs to be considered as an “advertising” buyer. For example, implement end-to-end analytics or ask questions like “how did you find out about the store.”

Count only buyers from a specific channel. If we count CAC from contextual advertising, the number of clients includes only those who came from an ad. If with SEO - those who came from organic search results. And existing clients who were there before the advertising was launched are not taken into account in the calculation.

- +99361130929

- Н.Гуллаева,дом 33, MCT Agency, Ashgabat, Turkmenistan

- academy@mctagency.com

- startup_tm.com