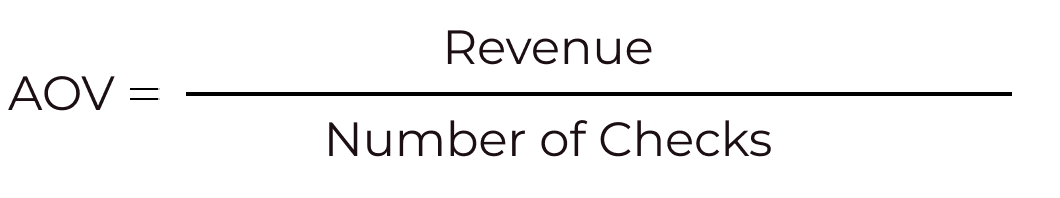

For example, you own a coffee shop and your monthly revenue is 5,250 manats. This month you had 30 orders. Then the average check = 5,250 / 30 = 175 manat.

Analysis of the indicator allows you to track how well the company is doing, as well as evaluate the effectiveness of advertising and the work of employees.

If you come to the store for one product, but instead take home two large bags, it means the store has done a good job of increasing the average check

Why calculate the average check

Average bill is one of the main indicators of successful business development. Ideally, AOV should increase or at least not decrease. A decrease in the average check is an alarm bell. Even if revenue grows due to attracting new customers, in the long run this will have a very negative impact on the company’s work. This means that you need to regularly monitor the average bill and, if it begins to decline, immediately find out the reason and take action.

Analysis of the average check helps:

Evaluate marketing. Imagine that the company launched a promotion with a gift for orders over 200 mana, calculated the average bill before and after its completion - and it remained at around 80 mana. This means that the offer turned out to be uninteresting to the audience or that marketers did not convey the information well to their customers. In any case, there is something to think about in order to get a better result next time.

Draw conclusions about the solvency of the audience. The average bill shows how much customers are willing to spend on your products and services. If AOV falls, this may indicate a decrease in purchasing power and the need for price adjustments.

Identify seasonality. Monthly monitoring of AOV helps to identify the dependence of sales on the time of year, prepare promotional offers in advance and “play” with prices.

Determine employee performance. With the arrival of the new head of the commercial department, the average check after some time decreased significantly, but at another outlet it remained the same. This may indicate poor staff training, low involvement and motivation of salespeople in a particular store.

Why calculate the average check

At first glance, the formula for calculating AOV seems simple. But there are a number of business features that need to be taken into account.

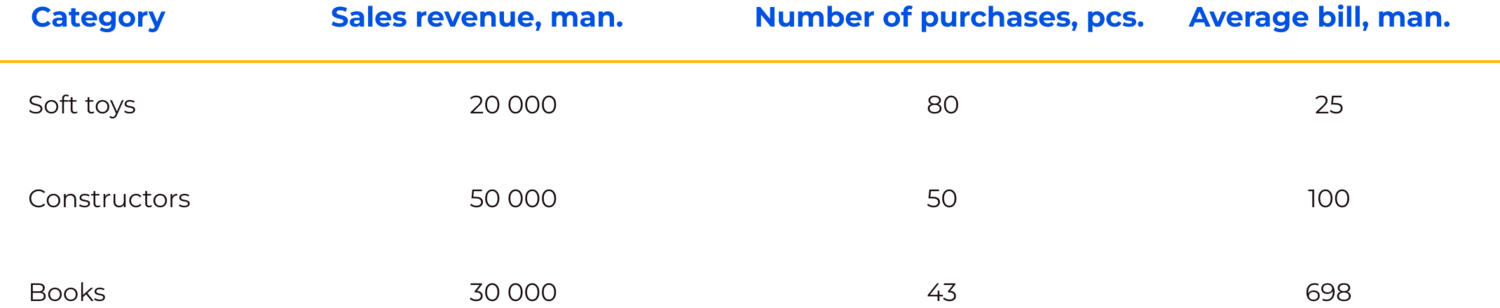

If you have a store with a huge assortment of different products, then it is better to calculate the average bill for each category.

For example, in a children's store you sell soft toys, construction sets and books.

The table shows that your customers most often buy soft toys. At the same time, the average bill in this category is the lowest. To increase the average check, you can try to expand the range in the middle price segment of soft toys and/or offer increased cashback in points for the purchase of goods from this category.

It also makes sense to calculate the average bill separately for the mass market and the premium segment of consumers. This will help to better analyze audience behavior and business advertising activity.

This is especially true for small stores. For example, in a boutique you sell high-end expensive perfume and popular mid-price perfume. Purchasing even one unit of a premium product can affect the average check. Without taking this fact into account, you risk drawing incorrect conclusions about the results of marketing activities.

- +99361130929

- Н.Гуллаева,дом 33, MCT Agency, Ashgabat, Turkmenistan

- academy@mctagency.com

- startup_tm.com